I Got My Financial Aid Packages - How Do I Decide What College to Attend?

This article breaks down the various parts of a financial aid package, so you can understand:

How much debt will you be taking on with your financial aid offers?

How much will you have to work with your offers?

What about cost of living?

You’ll learn how to break down each piece of your financial aid offers.

If you still have a gap, don’t be afraid to communicate with the financial aid office.

How Do I Analyze My Financial Aid Offers and Commit to a College?

You’ve gotten all of your acceptances, received your financial aid packages, and are ready to make a decision - but financial aid packages are extremely tricky to understand. So how do finances inform your college decision?

Parts of a financial aid package

First of all, never make a college decision without first receiving and analyzing your financial aid package, unless you are able to pay full costs of attendance out of pocket, right now. Beyond just cost of tuition, there are several components to consider: scholarship/grants, expected family contribution, loans (subsidized and unsubsidized), and work study.

Your financials are split into four types:

Money you don’t have to pay back: grants from the school, federal government, and state government (scholarships)

Money you have to pay now: expected family contribution

Money you have to work for: work study

Money you have to pay later: loans

How much debt will you be taking on?

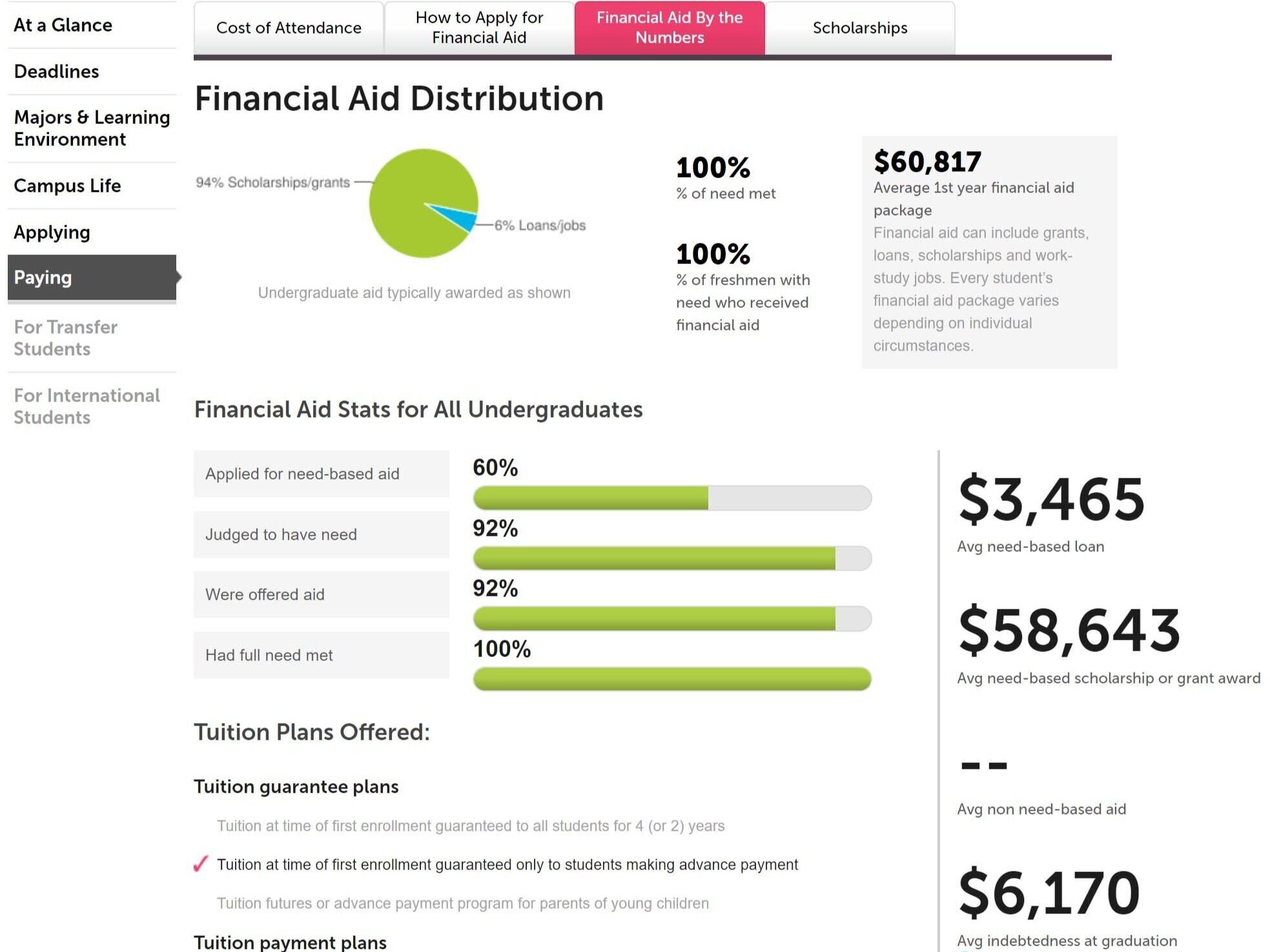

Obviously, you want that first type — free money! — to be maximized. What many people don’t realize, however, is that you also want to minimize #4, loans that you’ll have to deal with later. These will only increase with interest, particularly unsubsidized loans (which accrue interest while you’re still in college!) and end up being a huge burden. Use bigfuture.collegeboard.org to look up the average indebtedness at graduation of a school:

Search for your school.

Scroll down

Select “Financial Aid By the Numbers”.

Scroll down for “Avg. indebtedness at graduation”.

How much will you be working?

Work study is a great option, and having a job in college is totally feasible! However, be cautious about how many hours you’ll have to work to earn your work study amount. You definitely want to avoid work study interfering with your studies. (Side note: jobs like library aides or student guards often have free time to work on your homework while earning work study money!)

Cost of living

Don’t forget that there are costs associated with college outside of tuition. Make sure you know how much housing, a meal plan, books, and travel are going to cost, and see whether those are factored into your financial aid package.

How to break down your offers

Use an excel sheet to compare, line by line, how much of each type of funding each college is offering you.

Compare which school is giving you the most free money (green), the least debt (blue), and a reasonable amount of expected family contribution (red) and work study (pink) - you need to evaluate the gap between cost and money. Ideally, that gap is $0, but anywhere below $5,000 is good. Once you’ve analyzed your options, have an honest conversation with your family about what is feasible and reasonable for you.

Communicate with the financial aid office.

Colleges all do financial aid slightly differently, so don’t be afraid to reach out with questions! Remember, they want you to attend and want to make it work for you. Some helpful questions to ask are:

Is my award likely to stay the same after multiple years?

Does my work study count towards my tuition or just go straight to me?

This currently isn’t feasible for my family - do you have flexibility to increase this award?

For more advice on interpreting your financial aid letter, check out this blog! If you’re an international student looking for financial aid, read our tips here!

Remember, this decision can affect you financially for years — so make sure you understand all parts of your financial aid!