In 2016, when my first child started college, Harvey Mudd College in California was the most expensive college in the country, with a total cost of attendance of just over $70,000 per year. In 2020, when child number two started school, Columbia topped the list at $81,000.

In 2016, when my first child started college, Harvey Mudd College in California was the most expensive college in the country, with a total cost of attendance of just over $70,000 per year. In 2020, when child number two started school, Columbia topped the list at $81,000.

For the 2020-2021 school year, the University of Miami’s total cost of attendance for an undergraduate living on campus was $75,230. This fall, it’s expected to be $93,666. That’s an increase of 24.5%. When my son decided to go to Miami in 2020, we had no idea the cost would rise so high, so fast. Thankfully, he received a large merit scholarship and is graduating on time this month.

Miami isn’t the only school whose cost of attendance for the upcoming school year will be over $90,000. In fact, several colleges have now crossed the $90,000 per year threshold and some are approaching an eye-popping $100,000 per year. According to The New York Times, Vanderbilt is expected to charge $98,426 for engineering students in 2024-2025. If you happen to live in Los Angeles or London, your travel expenses could easily put your total cost of attendance above $100,000.

Even at public colleges and universities, costs are rising. Much of this increase is due to a drop in funding from states following the 2008 financial crisis. According to the College Board, “. . . declines in state and local funding . . . were followed by large percentage increases in tuition and fees . . .” In a segment on Last Week Tonight with John Oliver,* the former head of Louisiana State University, F. King Alexander, explained that in 2008, 70% of the school’s funding came from the state government, with just 30% coming from students in the form of tuition and fees. By 2016, only 20% was provided by the state, leaving students to make up the remaining 80%.

At the same time that states reduced funding, colleges began spending more money. Public universities can charge out-of-state and international students up to three times more than they charge in-state students. But, colleges need amenities to lure those students to their campuses. Think not only state of the art labs and facilities, but resort-like features such as luxury dorms, climbing walls and lazy rivers. Every student is contributing to these costs.

Most students don’t pay the full cost of attendance thanks to grants and scholarships, which is great. But, for those who take out student loans to afford college, the outcome can be less than ideal. Again, on Last Week Tonight, Brittney King, a student loan borrower, said, “It was just explained to us as everybody has student loans and this is just something you do to get ahead in life. To have a drink of alcohol you have to be 21. To take out $100,000 worth of debt you can be 18. You can do that, and I definitely did not understand what I was signing up for.”

Students can spend 20 plus years paying off these loans. By the time they’re finished, they’ve paid huge amounts of money in interest. Another student borrower told this story: “I started with $80,000 [in loans]. I have been paying for 10 years. The grand total I have paid is $120,000 and I still owe $76,000. How is this possible?

Even students who have taken out modest loans, under $25,000, are delaying life decisions such as getting married, having children and buying a house due to debt. And, while those things may seem unimportant to 18 year olds headed to college, that view may change sooner than you think.

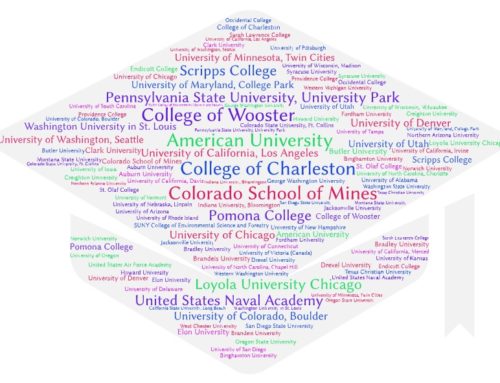

So, what can families do? Discovery College Consulting advises parents and students to have an honest discussion about college costs early in the process. Make certain everyone understands how much the family can afford per year. When we create a student’s college list, we keep the parents’ budget in mind, including only schools which align with their spending limit.

Taking out a small student loan isn’t the end of the world; after all, it might help for your student to have some skin in the game. But, if your child does take out a loan, be certain you understand how long it will take to pay off and what those monthly payments will be. You wouldn’t take out a mortgage or a car loan without knowing those things. You shouldn’t take out a college loan without all the information either. We recommend that all students, regardless of whether they plan to take out student loans, complete loan entrance counseling on the Federal Student Aid website. It will help you understand how debt works.

* This episode of Last Week Tonight is not only eye-opening, but also hilarious. Viewers should be aware it contains profanity.